UTI MNC Fund: A Thematic Mutual Fund for the long run

The UTI MNC Fund is an equity-based fund that predominantly invests in Multinational Companies. This thematic investment in MNC stocks is done because MNC stocks display a high level of operational and capital allocation efficiencies, strong cash flow and brand strength. MNCs also have high Return on Equity (RoE) and Return on Capital Employed (RoCE). The fund chooses companies with low financial leverage and high potential to become market leaders.

Contents

Performance

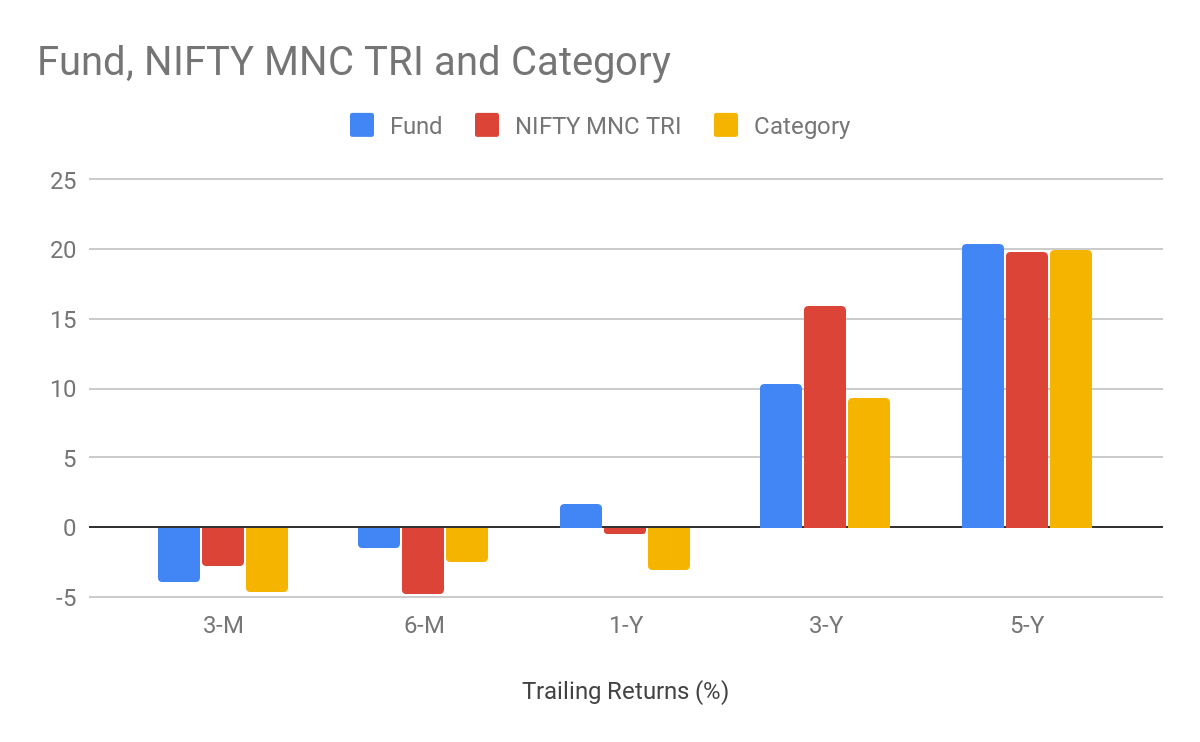

The UTI MNC Fund is a highly volatile fund as it invests a large majority of its corpus in mid-cap and large-cap companies. The fund follows a thematic method of investment by primarily focusing on MNC stocks. This fund has an approximate allocation of 40% to the mid-cap sector, which has caused the fund to be highly volatile due to the volatile market cycles taking place in this sector. The fund had a good performance in 2017 as both the Mid-cap sector and the large-cap MNC sectors were doing well, but in 2018 both these sectors tanked causing the fund to underperform against its benchmark and category. The fund has not performed well over short-medium investment horizons of up to 3 years but outperforms both its category and its benchmark, the NIFTY MNC Index, in a 5-year investment horizon. The annualized returns over 1-year, 3-year and 5-year investment horizons against the fund’s category and benchmark have been provided below.

|

Trailing Returns (%) |

3-M |

6-M |

1-Y |

3-Y |

5-Y |

|

Fund |

-3.98 |

-1.49 |

1.64 |

10.29 |

20.34 |

|

NIFTY MNC TRI |

-2.85 |

-4.72 |

-0.51 |

15.93 |

19.83 |

|

Category |

-4.7 |

-2.54 |

-3.05 |

9.28 |

19.94 |

Asset Allocation

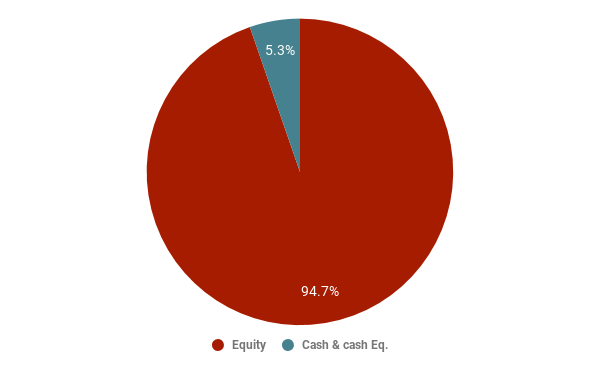

The UTI MNC Fund is an equity-based mutual fund that invests a minimum of 80% of the corpus in equity and equity-related instruments, the remaining 20% can be invested in debt or a mix of debt and other money-market instruments like Real Estate Investment Trusts (REIT) or Infrastructure Investment Trusts (InvITs). The asset allocation according to the mandate of this fund has been provided below.

|

Instrument |

Minimum Allocation |

Maximum Allocation |

Risk Profile |

|

Equity and equity related instruments (minimum 80% of the total assets would be in equity and equity-related instruments of multinational corporations/ companies) |

80% |

100% |

High |

|

Debt and Money Market instruments including securitized debt |

0 |

10% |

Moderate |

|

Units issued by REITs & InvITs |

0 |

10% |

Moderate |

The present asset allocation of this fund has been provided in the chart below.

Portfolio

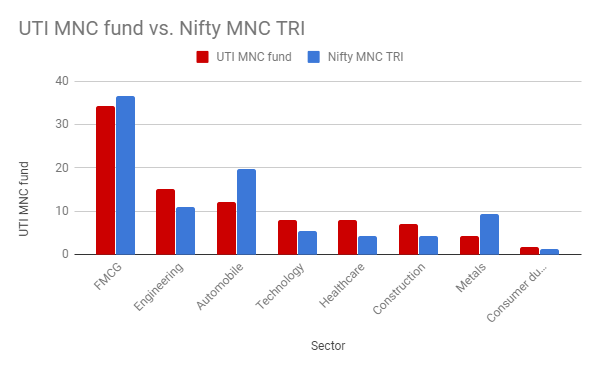

The UTI MNC Fund endeavors to maintain a diversified portfolio across sectors of the economy, the fund current invests heavily in the FMCG, Engineering, Automobile and Technology sectors of the economy. As this fund is an open-ended scheme the Fund Manager has the ability to change the sector allocation of the fund to adapt to the prevailing market conditions. The present sectoral allocation of the fund against the benchmark has been provided in the chart below.

Top Holdings

The top holdings of the UTI MNC Fund have been provided below

|

Company |

Sector |

PE |

3Y High |

3Y Low |

% Assets |

|

Hindustan Unilever |

FMCG |

69.79 |

9.96 |

6.07 |

9.31 |

|

Britannia Inds. |

FMCG |

69.2 |

8.47 |

3.77 |

8.32 |

|

Maruti Suzuki India |

Automobile |

28.99 |

9.87 |

5.19 |

7.94 |

|

Mphasis |

Technology |

18.98 |

7.44 |

2.97 |

6.15 |

|

United Spirits |

FMCG |

68.08 |

5.6 |

3.15 |

4.35 |

|

Sanofi India |

Healthcare |

38.27 |

4.45 |

2.97 |

4.2 |

|

Cummins India |

Engineering |

30.97 |

5.57 |

2.98 |

3.62 |

|

Ambuja Cements |

Construction |

26.91 |

6.25 |

3.48 |

3.6 |

|

Bosch |

Automobile |

38.02 |

7.57 |

3.42 |

3.52 |

|

Honeywell Automation |

Engineering |

64.71 |

3.25 |

1.35 |

3.25 |

Risk Profile

Equity Risk

The UTI MNC Fund is an equity-based mutual fund which has a large amount of its corpus invested in mid-cap and large-cap companies. Presently, the fund allocates approximately 40% of its corpus to the mid-cap sector and approximately 50% to the large-cap sector. The mid-cap sector of the market has been seeing high volatility in the past year and, therefore, exposing the fund to high levels of volatility. Volatility in the equity market can lead to a loss in investment including loss of capital. The fund also is exposed to a concentration risk which is usually sector-specific. Transfer procedures, trading volumes, and long settlement period can affect the liquidity of the fund.

Debt Risk

The fund allocates a nominal amount of its assets to debt and other stable money market instrument. Even though debt and money market instruments are considered relatively stable, they carry their own set of risks. Long-term debt instruments are drastically affected by changes in interest rates. A small drop in the interest rate could drastically affect the returns on the investment, thereby, affecting the Net Asset Value (NAV) of the fund. The fund is also exposed to credit risk, a risk that the issuer of a debt instrument will not fulfill the repayment obligation on the instrument due to financial concerns.

Risk Mitigation

Equity Risk Mitigation

The UTI MNC Fund strives to maintain a well-diversified portfolio across market sectors.A diversified portfolio helps mitigate the concentration risks, which is usually sector specific. The fund also endeavors to maintain an asset-liability balance to ensure timely payments at the time of redemption of units, this helps with the liquidity of the fund.

Debt Risk Mitigation

The UTI MNC Fund is cautious when selecting debt instruments, and only selects highly ranking debt instruments which have been ranked by SEBI registered credit agencies. The fund also endeavors to time the maturity period of the fund with expected interest rate cycles to mitigate interest rate risks associated with debt instruments.

Fund Manager

Ms. Swati Kulkarni

Ms. Kulkarni has a total work experience of 27 years in the finance sector, out of which she has worked with UTI AMC for 26 years. Before becoming a Fund Manager in 2004 she was a member of the Fund Management Team which provided analysis for companies across sectors to assist Fund Managers. She has performed Mutual Fund Research, Market Research, Product Reviews, and Quantitative Analysis as part of the Fund Management Team with UTI. Ms. Kulkarni holds a CFA charter conferred by the CFA Institute, USA.